The Greater Toronto Area (GTA) experienced the best home sales result for the month of July since 2021. Sales were also up relative to listings, suggesting a modest tightening in the market compared to last year.

“Improved affordability, brought about by lower home prices and borrowing costs is

starting to translate into increased home sales. More relief is required, particularly where

borrowing costs are concerned, but it’s clear that a growing number of households are

finding affordable options for homeownership,” said Toronto Regional Real Estate Board

(TRREB) President Elechia Barry-Sproule.

GTA REALTORS® reported 6,100 home sales through TRREB’s MLS® System in July 2025 – up

by 10.9 per cent compared to July 2024. New listings entered into the MLS® System totalled

17,613 – up by 5.7 per cent year-over-year.

On a seasonally adjusted basis, July home sales increased month-over-month compared

to June 2025. New listings also rose compared to June, but by a much lesser rate. With

sales increasing relative to listings, market conditions tightened.

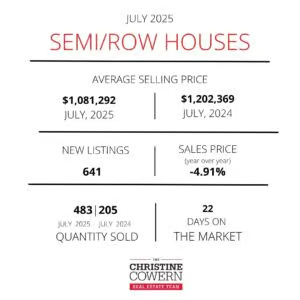

The MLS® Home Price Index Composite benchmark fell by 5.4 per cent year-over-year in

July 2025. The average selling price, at $1,051,719, was down by 5.5 per cent compared to

July 2024. On a month-over-month seasonally adjusted basis, the MLS® HPI Composite

and average selling price remained flat compared to June.

“Recent data suggest that the Canadian economy is treading water in the face of trade

uncertainty with the United States. A key way to mitigate the impact of trade uncertainty is

to promote growth in the domestic economy. The housing sector can be a catalyst for

growth, with most spin-off expenditures accruing to regional economies. Further interest

rate cuts would spur home sales and see more spin-off expenditures, positively impacting

the economy and job growth,” said TRREB Chief Information Officer Jason Mercer.

“Despite widespread belief that the federal foreign buyer ban prohibits all foreign nationals

from purchasing residential properties in Canada, there are exemptions that allow nonresidents to buy property, resulting in spin-off benefits to the economy. Foreign buyers can purchase multi-unit buildings with four or more units and vacant land or land for

development. Non-residents can also buy other residential properties outside urban

centres, including recreational properties,” said TRREB CEO John DiMichele.

“Moreover, temporary workers and international students can purchase residential

property under defined circumstances under the ban extended until January 2027,”

continued DiMichele.

CONDO MARKET STATS

If you’re thinking of selling or buying a property or just want to pick our brains, we’re here to help! Just email us at hello@christinecowern.com or call us at 416-291-7372. We’d love to connect!