The Greater Toronto Area (GTA) housing market experienced a marked adjustment in 2022 compared to record levels in 2021. Existing affordability issues brought about by a lack of housing supply were exacerbated by sustained interest rate hikes by the Bank of Canada.

“Following a very strong start to the year, home sales trended lower in the spring and summer of 2022, as aggressive Bank of Canada interest rate hikes further hampered housing affordability. With no relief from the Office of Superintendent of Financial Institutions (OSFI) mortgage stress test or other mortgage lending guidelines including amortization periods, home selling prices adjusted downward to mitigate the impact of higher mortgage rates. However, home prices started levelling off in the late summer, suggesting the aggressive early market adjustment may be coming to an end,” said new Toronto Regional Real Estate Board (TRREB) President Paul Baron.

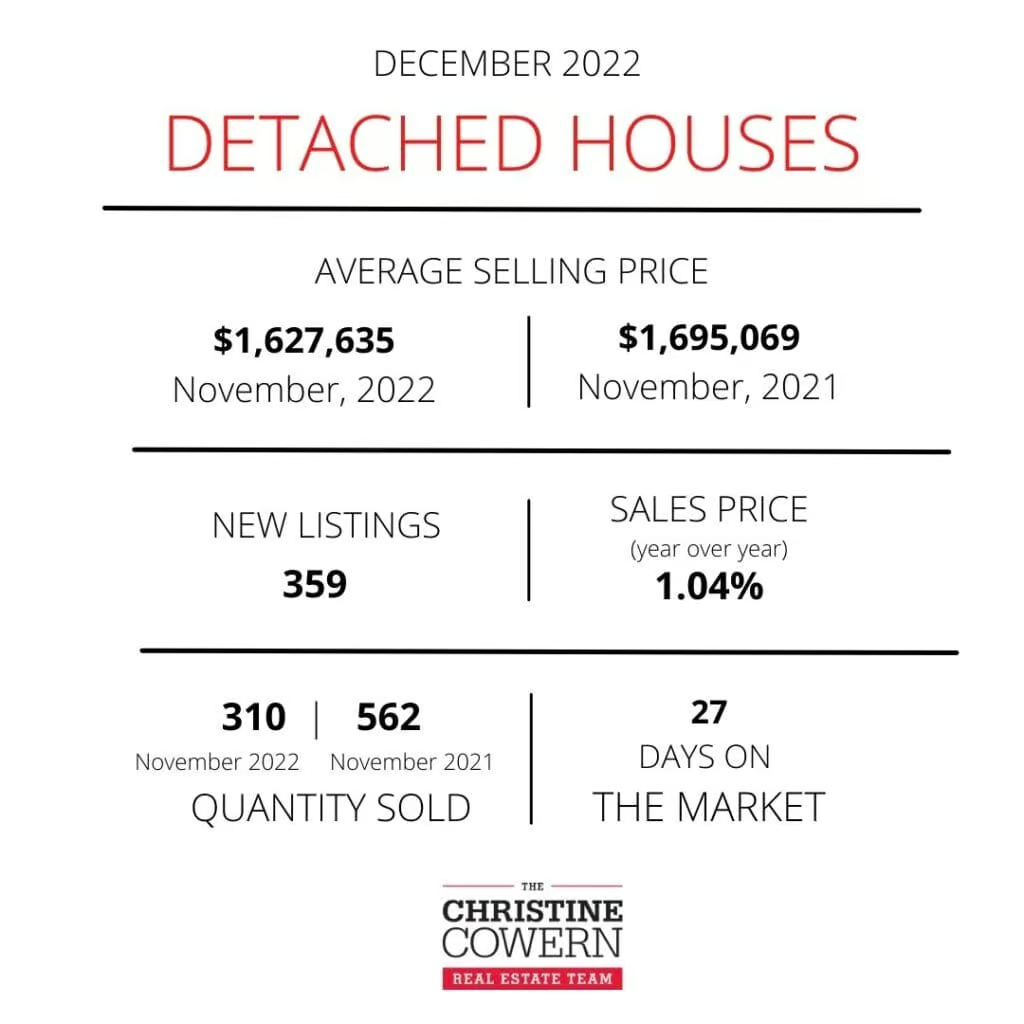

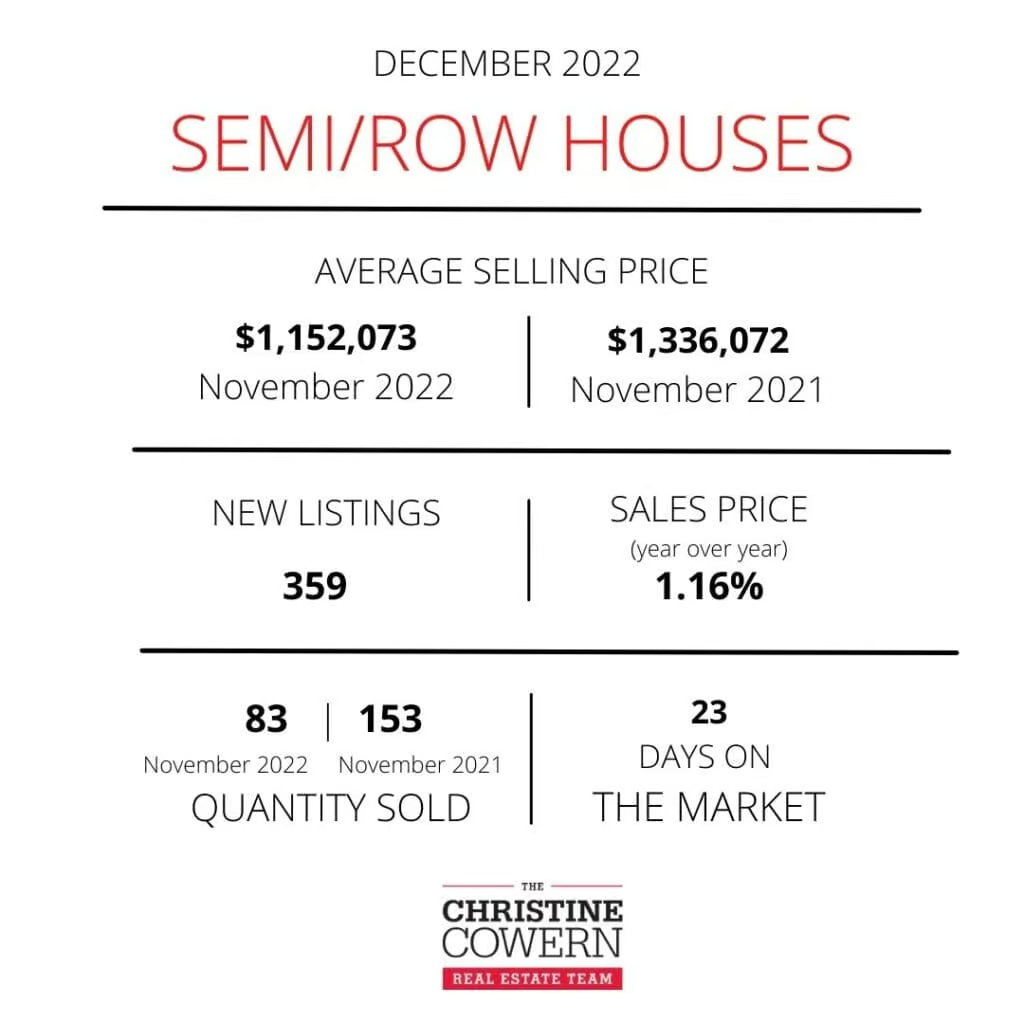

There were 75,140 sales reported through TRREB’s MLS® System in 2022 – down 38.2 percent compared to the 2021 record of 121,639. The number of new listings amounted to 152,873 – down 8.2 percent compared to 166,600 new listings in 2021. Seasonally adjusted monthly data for sales and price data show a marked flattening of the sales and price trends since the late summer.

“While home sales and prices dominated the headlines in 2022, the supply of new listings continued to be an issue as well. The number of homes listed for sale in 2022 was down in comparison to 2021. This helps explain why selling prices have found some support in recent months. Lack of supply has also impacted the rental market. As renting has become more popular in this higher interest rate environment, tighter rental market conditions have translated into double-digit average rent increases”, said TRREB Chief Market Analyst Jason Mercer.

The average selling price for 2022 was $1,189,850 – up 8.6 percent compared to $1,095,333 in 2021. This growth was based on a strong start to the year, in terms of year-over-year price growth. The pace of growth moderated from the spring of 2022 onwards.

CONDO MARKET REPORT

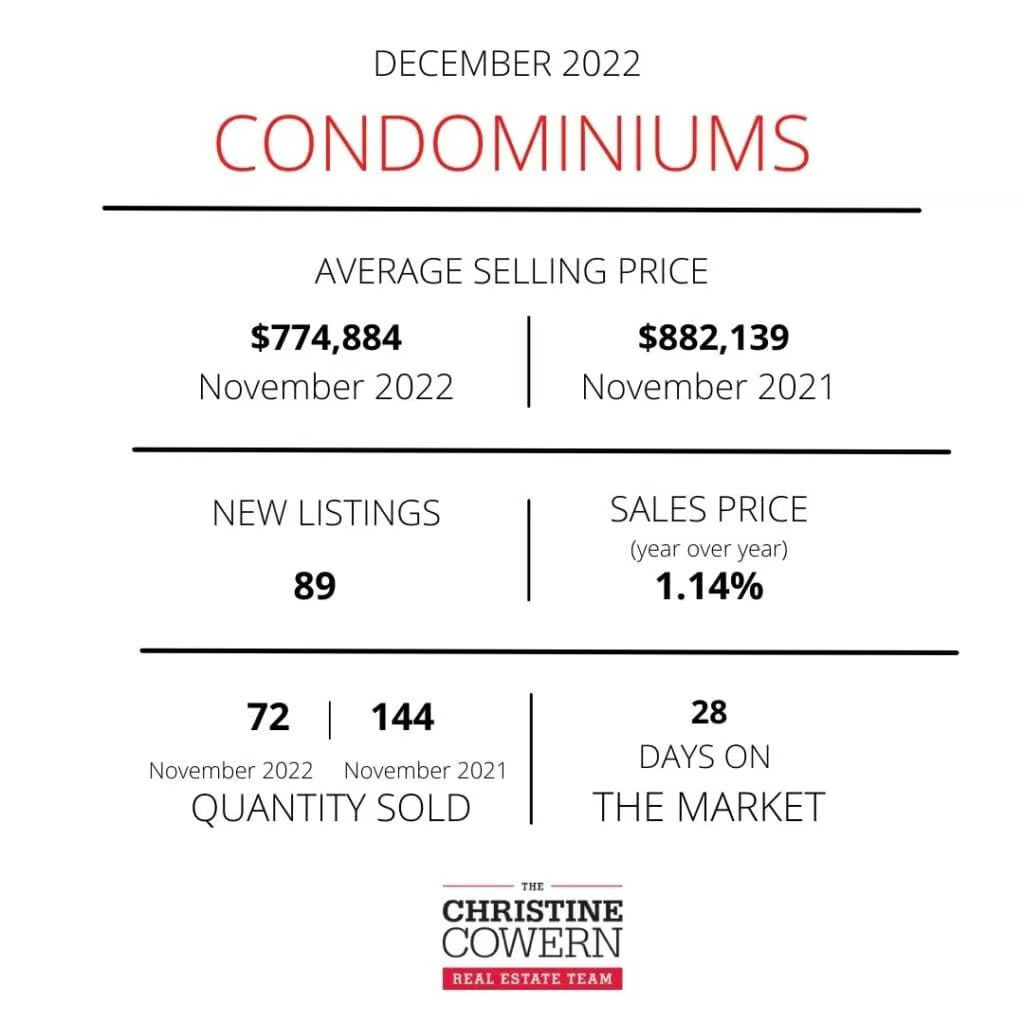

Following the ownership market as a whole, Q3 2022 condominium apartment sales were off by approximately 46 percent compared to Q3 2021. Despite there being substantially more balance in the market in the third quarter relative to a year earlier, the average selling price was up year-over-year, albeit by less than the current pace of inflation.

There were 4,177 condo apartment sales reported through TRREB’s MLS® System in Q3 2022 compared to 7,795 in Q3 2021. The number of new listings was also down over the same period by 16 percent to 10,258.

“The condo market remains a very important segment in the GTA housing market, both in terms of ownership and rental. The ownership side of the market has been slower, as some first-time buyers have been sidelined by higher borrowing costs and the hit on affordability. Many of these would-be buyers have shifted to the condo rental market in the short-to-medium term to meet their housing needs,” said TRREB President Kevin Crigger.

The average selling price for condominium apartments in Q3 2022 was $720,132 – up 4.5 percent compared to $689,230 reported for Q3 2021. In the City of Toronto, the average selling price was $749,375 – up 3.3 percent.

“The pace of condo price growth has moderated as higher borrowing costs have hampered affordability since the spring. However, the impact has been mitigated to a certain degree by a dip in listings over the same period. A shorter supply of condos will likely provide some support for prices in the months ahead,” said TRREB Chief Market Analyst Jason Mercer.

If you’re thinking of selling or buying a property or just want to pick our brains, we’re here to help! Just email us at hello@christinecowern.com or call us at 416-291-7372. We’d love to connect!