There were 4,912 home sales Toronto Regional Real Estate Board (TRREB) MLS® System in July 2022 reported through the down by 47 per cent compared to July 2021. Following the regular seasonal trend, sales were also down compared to June. New listings also declined on a year-over-year basis in July, albeit down by a more moderate four per cent. The expectation is that the trend for new listings will continue to follow the trend for sale move through the second half of 2022 and into 2023.

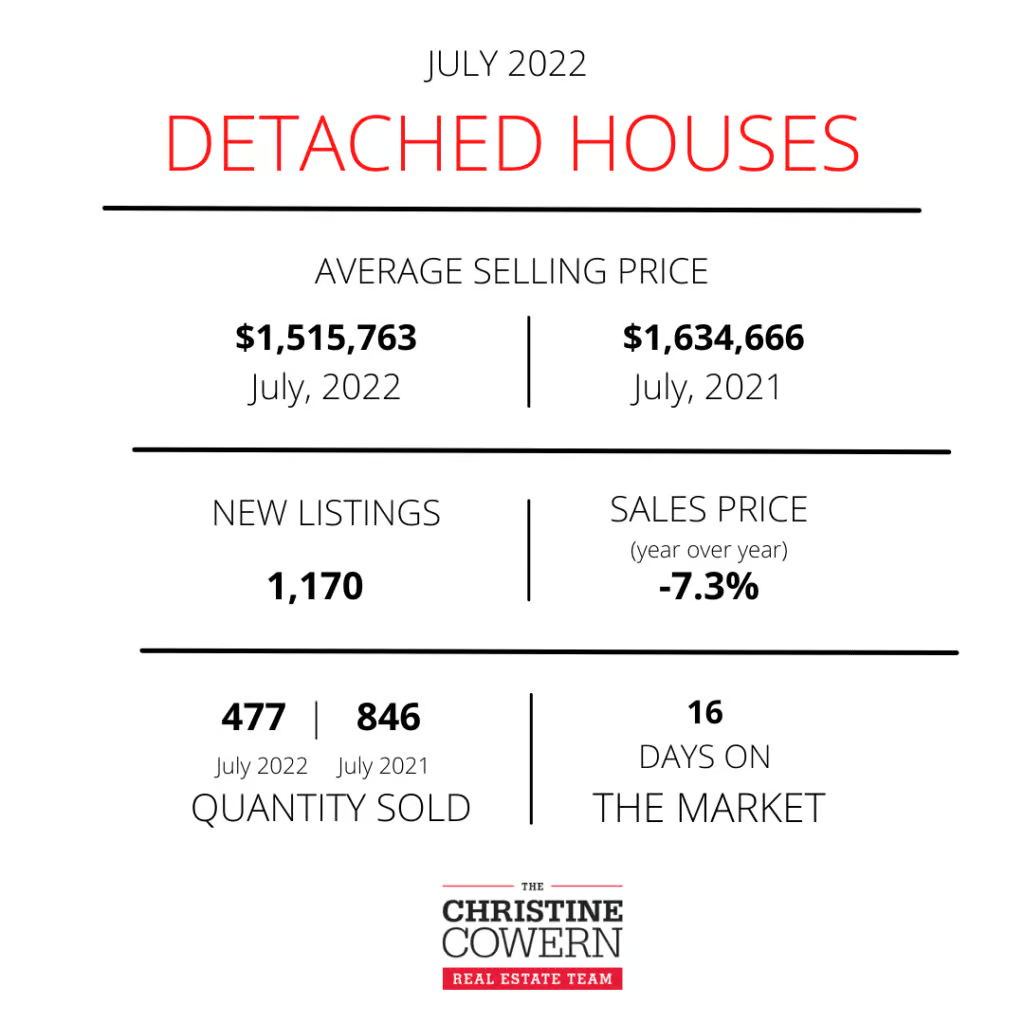

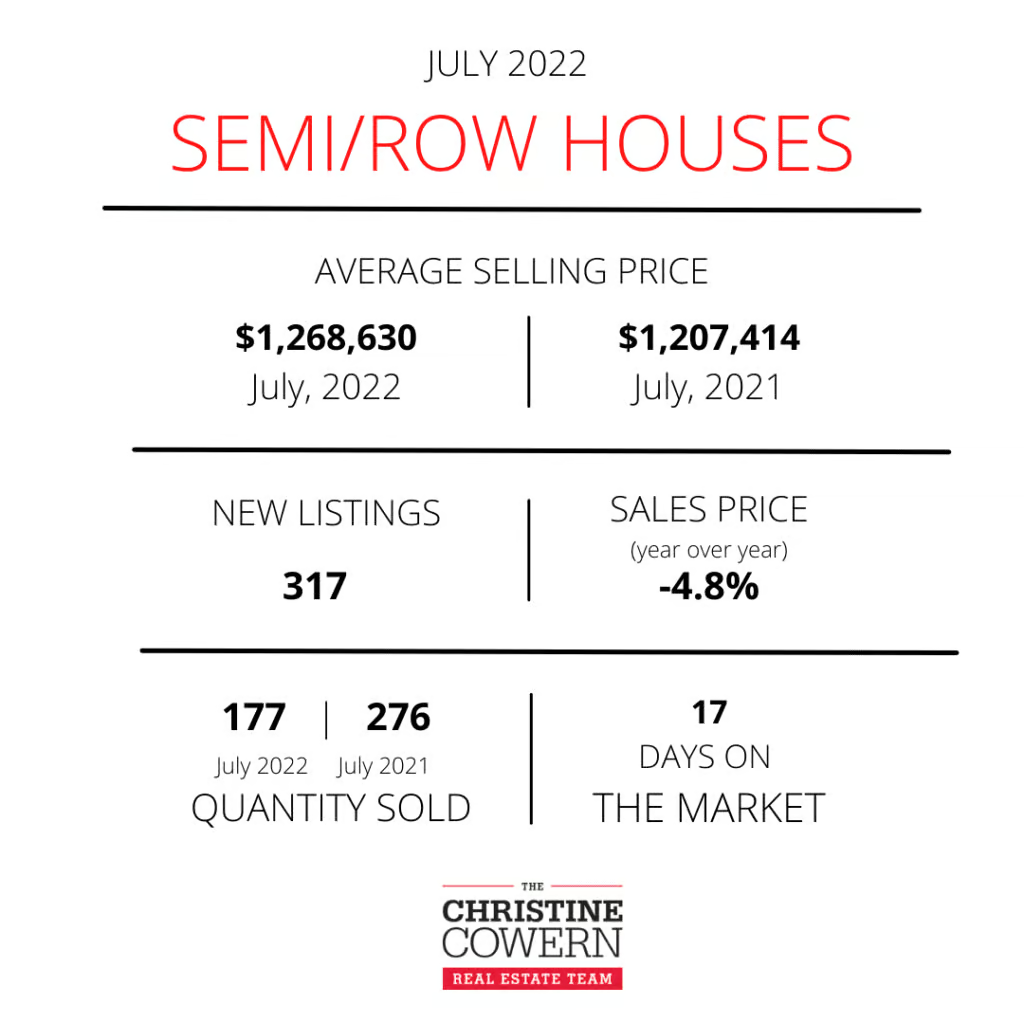

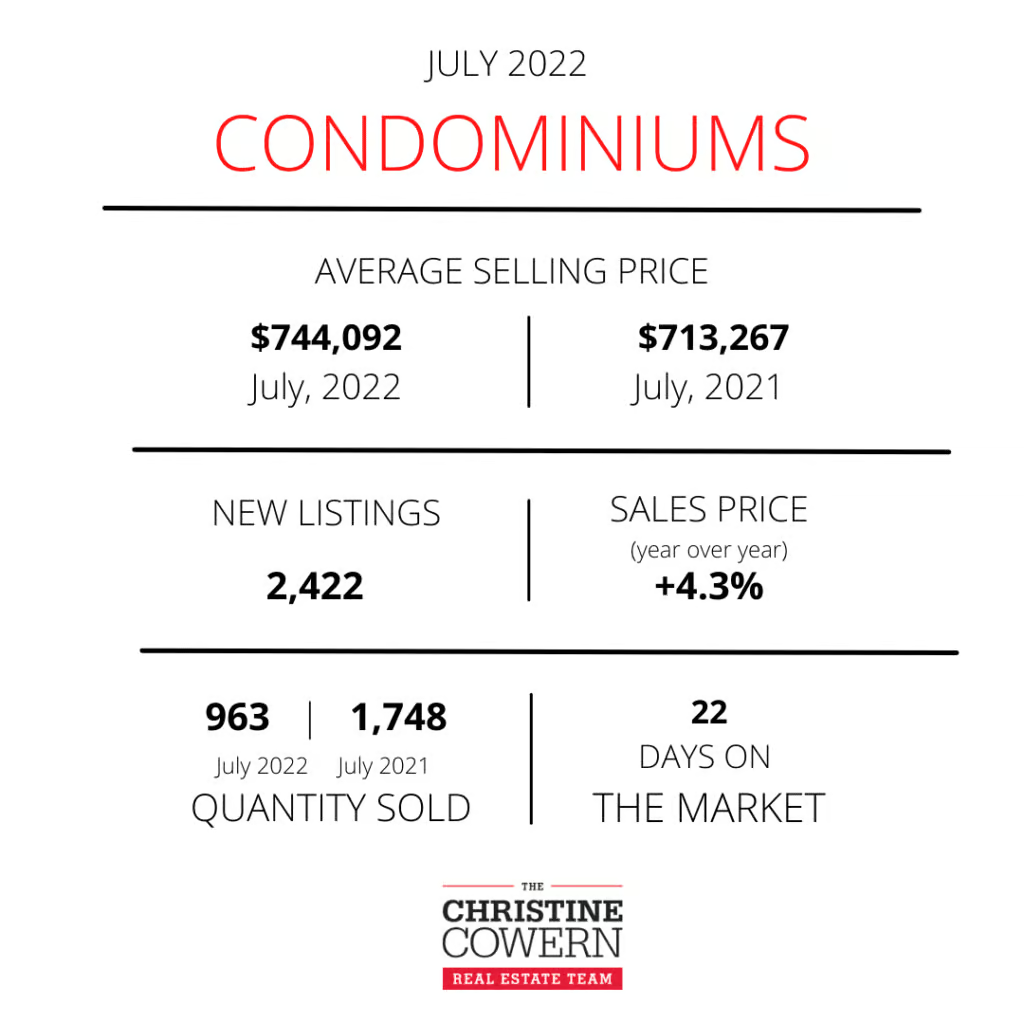

Market conditions remained much more balanced in July 2022 compared to a year earlier. As buyers continued to benefit from more choice, the annual rate of price growth has moderated. The MLS® Home Price Index (HPI) Composite Benchmark was up by 12.9 per cent year-over-year. The average selling price was up by 1.2 per cent compared to July 2021 to $1,074,754. Less expensive home types, including condo apartments, experienced stronger rates of price growth as more buyers turned to these segments to help mitigate the impact of higher borrowing costs.

“The Greater Toronto Area (GTA) population continues to grow and tight labour market conditions will drive this growth moving forward. Despite more balanced market conditions resulting from rapidly increasing mortgage rates, policymakers must continue to take action to boost housing supply to account for long term population growth. TRREB has put realistic solutions on the table to address the existing housing affordability challenges. With savings high and the unemployment rate still low, home buyers will eventually account for higher borrowing costs. When they do, we want to have an adequate pipeline of supply in place or market conditions will tighten up again,” said TRREB Chief Market Analyst Jason Mercer.

TRREB is also calling on all levels of government to reassess and clarify policies related to mortgage lending and housing development.

“Many GTA households intend on purchasing a home in the future, but there is currently uncertainty about where the market is headed. Policymakers could help allay some of this uncertainty. As higher borrowing costs impact housing markets, TRREB maintains that the OSFI mortgage stress test should be reviewed in the current environment. Consumers looking to renew their existing mortgages with a different lender should not be subject to an additional stress test burden beyond what they would face with their existing lender. Given the importance of the housing industry as a driver of economic growth, a transparent process and sound rationale in the development and management of stress test guidelines are also of utmost importance,” said TRREB CEO John DiMichele.

“With significant increases to lending rates in a short period, there has been a shift in consumer sentiment, not market fundamentals. The federal government has a responsibility to not only maintain confidence in the financial system, but to instill confidence in homeowners that they will be able to stay in their homes despite rising mortgage costs. Longer mortgage amortization periods of up to 40 years on renewals and switches should be explored. With the benefit of hindsight, it appears that the Bank of Canada’s rate increases started too late. Now we are dealing with outsized increases to curb generationally high inflation. The federal government must enact measures which will assist buyers facing affordability challenges in an inflationary environment where costs are rising at the gas pumps, the grocery stores and everywhere in between,” said TRREB President Kevin Crigger.

“The provincial government, elected on a platform of bolstering housing supply and increasing housing affordability, must take swift action as it relates to significantly rising municipal government fees across the GTA, such as development charges which are largely borne by home buyers. City of Toronto Council should reflect on its recently approved 46 per cent increase to development charges, bringing the average cost of all government charges and fees to an astounding $350,000+ for every new detached house and over $180,000 for a new condominium. We do commend the City for providing an exemption from development charges for up to three additional units on single lots which will encourage more missing middle multiplex housing, but this exemption alone is not enough. Every level of government agrees that the GTA needs more homes. Governments must stop their reliance on significant charges and fees on new homes and unpredictable taxes on existing homes or we will continue to see a growing housing crisis that will eventually inhibit the growth of the GTA’s economy. With a municipal election this fall, governments will be judged based on the steps they take,” added Crigger.

CONDO MARKET REPORT

As the market is shifting towards balance buyers generally will see more options available when it comes to condos. First time home buyers who have been temporarily sitting on the sidelines of the market are slowly coming back to the playing field and exploring the lower average pricepoint in the condo market to mitigate the impact of higher borrowing costs associated with higher price points.

If you’re thinking of selling or buying a property or just want to pick our brains, we’re here to help! Just email us at hello@christinecowern.com or call us at 416-291-7372. We’d love to connect!