Higher borrowing costs continued to impact home sales in June 2022. Sales totalled 6,474 – down by 41 per cent compared to last year’s strong result. The number of transactions was also down compared to May 2022, but this is often the case due to the seasonal nature of the market.

Are you curious about navigating the local Toronto real estate market? Check out some of our resources for buyers and sellers here:

- How Toronto Interest Rate Increases Will Impact You

- Can Toronto Homeowners Benefit From Balance in the Real Estate Market?

- Blog Category: Real Estate Market Updates

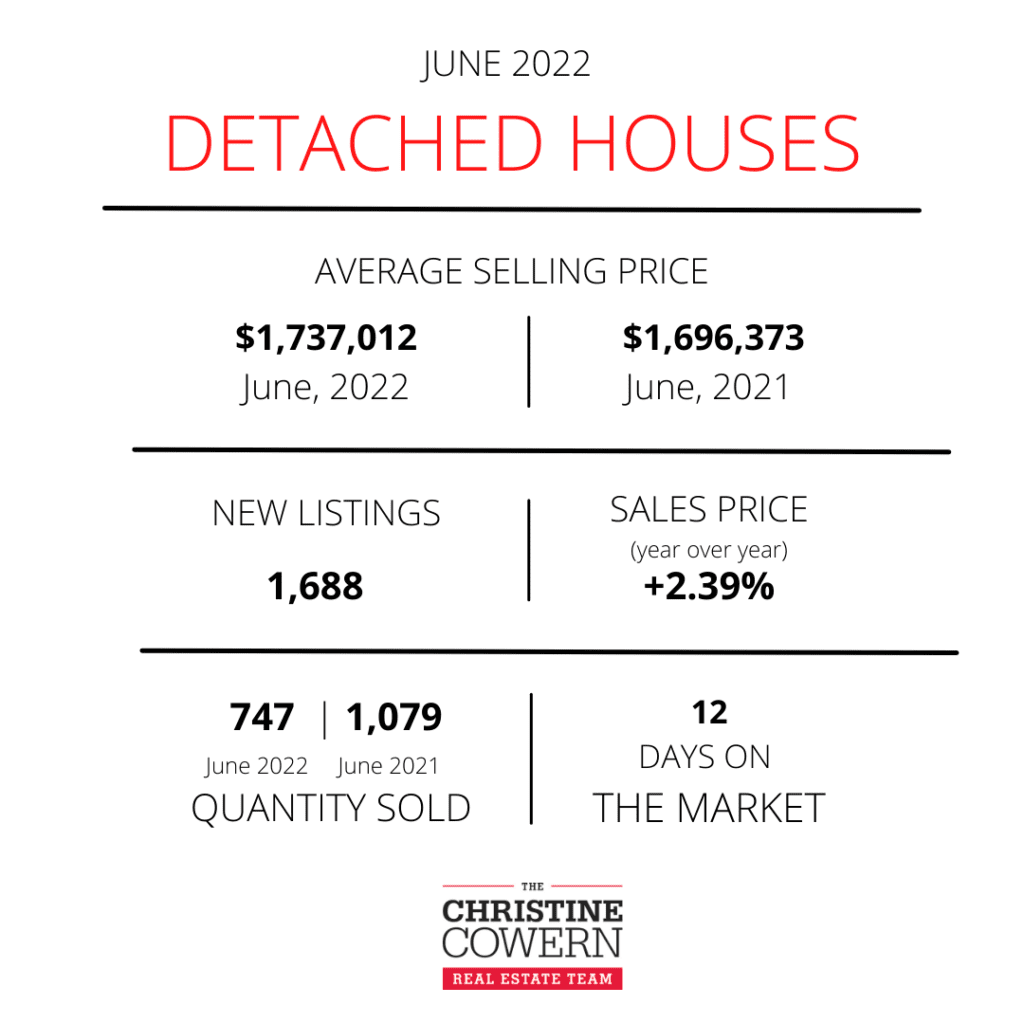

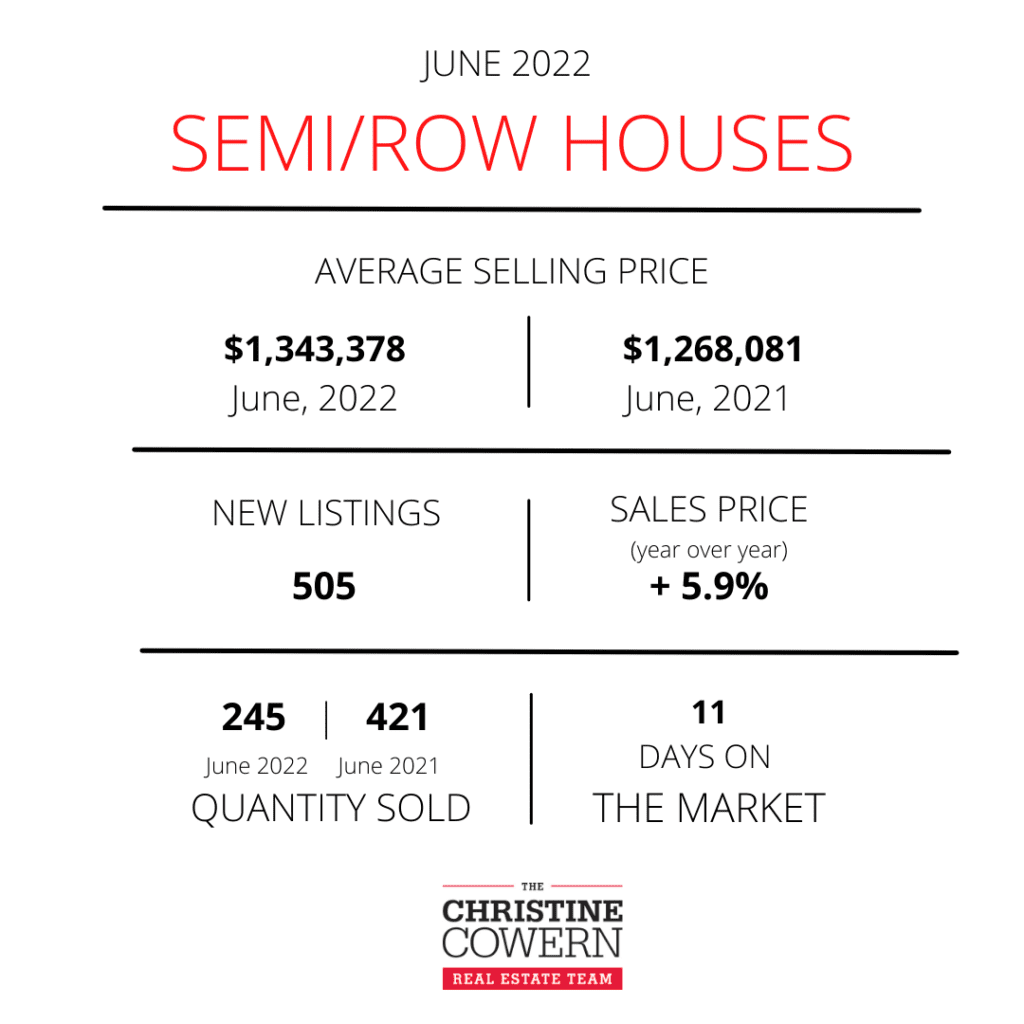

The average selling price, at $1,146,254, remained 5.3 per cent above the June 2021 level, but continued to trend lower on a monthly basis. The MLS® Home Price Index Composite benchmark was up by 17.9 per cent year-over-year, but also experienced a month-over-month dip compared to May. Annual price growth was driven more so by less expensive market segments, including townhouses and condominium apartments.

“Home sales have been impacted by both the affordability challenge presented by mortgage rate hikes and the psychological effect wherein home buyers who can afford higher borrowing costs have put their decision on hold to see where home prices end up. Expect current market conditions to remain in place during the slower summer months. Once home prices stabilize, some buyers will re-enter the market despite higher borrowing costs,” said TRREB President Kevin Crigger.

While the number of transactions was down year-over-year, the number of new listings was little changed over the same period. This has provided for more balance in the market, resulting in a more moderate annual pace of price growth.

“Listings will be an important indicator to watch over the next few months. With the unemployment rate low, the majority of households aren’t in a position where they need to sell their home. If would-be sellers decide to take a wait-and-see attitude over the next few months, it’s possible that active listings could trend lower as well. This could cause market conditions to tighten somewhat, providing some support for home prices,” said TRREB Chief Market Analyst Jason Mercer.

“Our region continues to grow because we attract people and businesses from all around the world. All of these people will require a place to live, whether they choose to buy or rent. Despite the shorter-term impact of higher borrowing costs, housing demand will remain strong over the long-term, as long as we can produce homes within which people can live. Policy makers at all levels need to make this their key goal,” said TRREB CEO John DiMichele.

CONDO MARKET REPORT

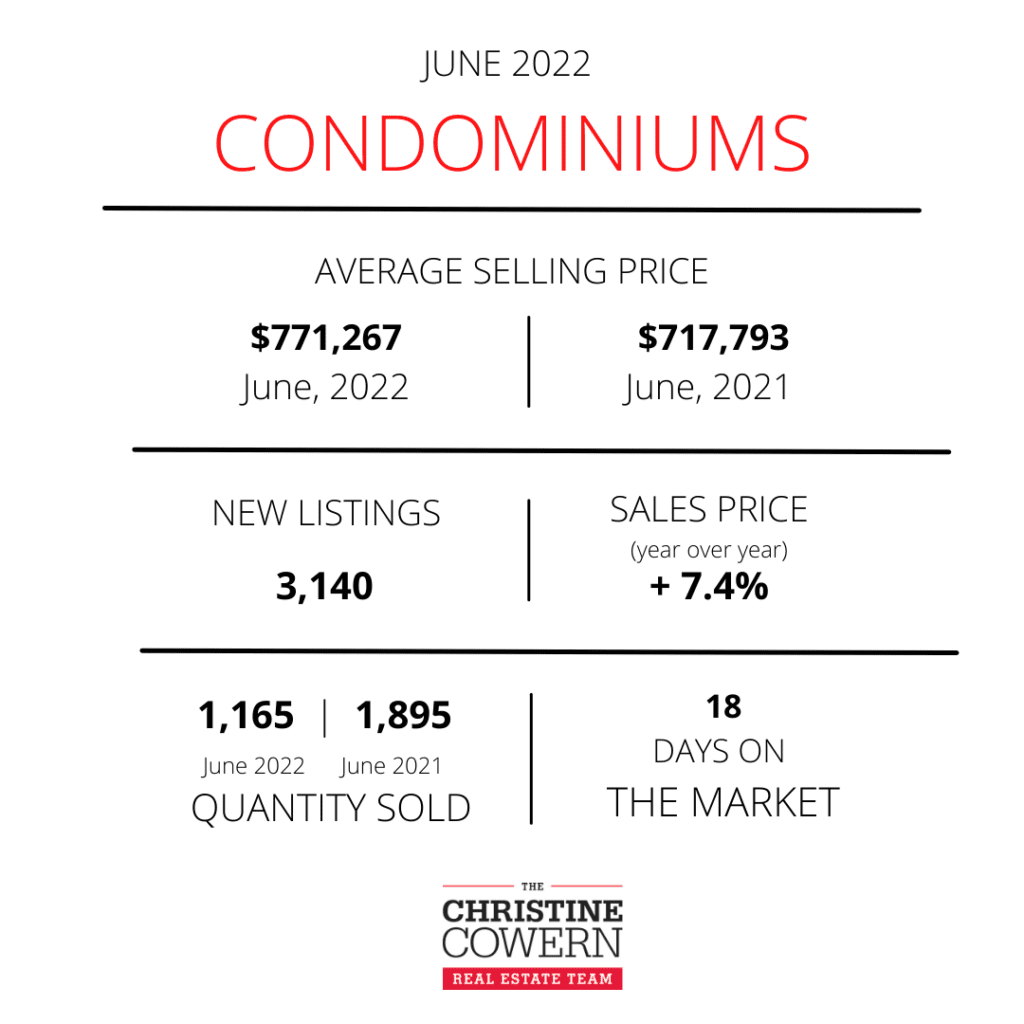

In June, 2022 the average condo selling price in the Greater Toronto Area increased by 9.3% year-over-year. In Toronto, the increase was 7.4%. The sales price to list price ratio was 100.4%, meaning that on average, condo properties sold above asking. This speaks to a seller’s market that remains strong.

Buyers saw a comparable number of new condo listings (3,307 in June 2021, 3,140 in June 2022). While challenged by higher borrowing costs, buyers will still find choice as the market moves toward balance. Toronto’s vibrancy and rising population makes an investment or residential condo purchase a sound decision.

If you’re thinking of selling or buying a property or just want to pick our brains, we’re here to help! Just email us at hello@christinecowern.com or call us at 416-291-7372. We’d love to connect!