Higher borrowing costs, continued uncertainty about the economy and Bank of Canada decision-making, and the constrained supply of listings resulted in fewer home sales in August 2023 compared to August 2022. The average selling price remained virtually unchanged over the same period. On a seasonally adjusted monthly basis, sales and average price edged lower.

“Looking forward, we know there will be solid demand for housing – both ownership and rental – in the Greater Toronto Area and broader Greater Golden Horseshoe. Record immigration levels alone will assure this. In the short term, we will likely continue to see some volatility in terms of sales and home prices, as buyers and sellers wait for more certainty on the direction of borrowing costs and the overall economy,” said TRREB President Paul Baron.

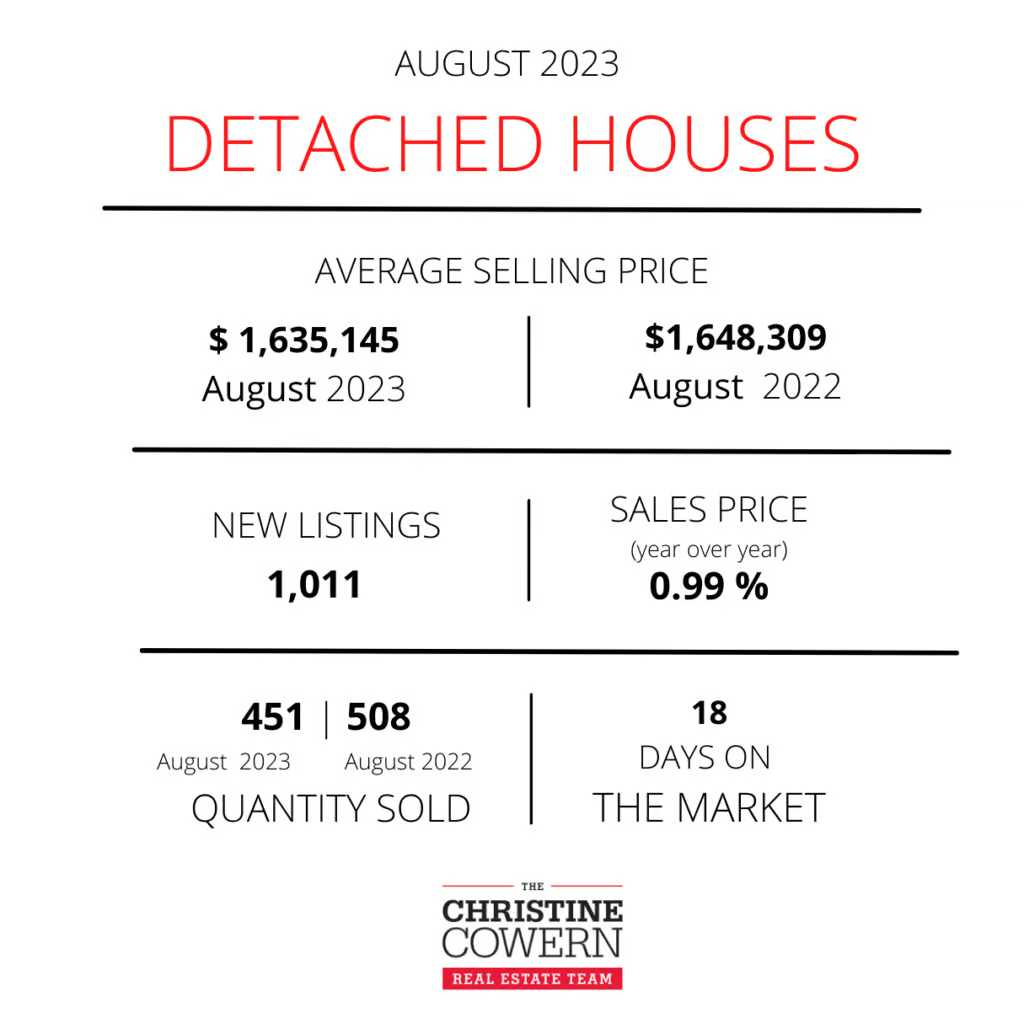

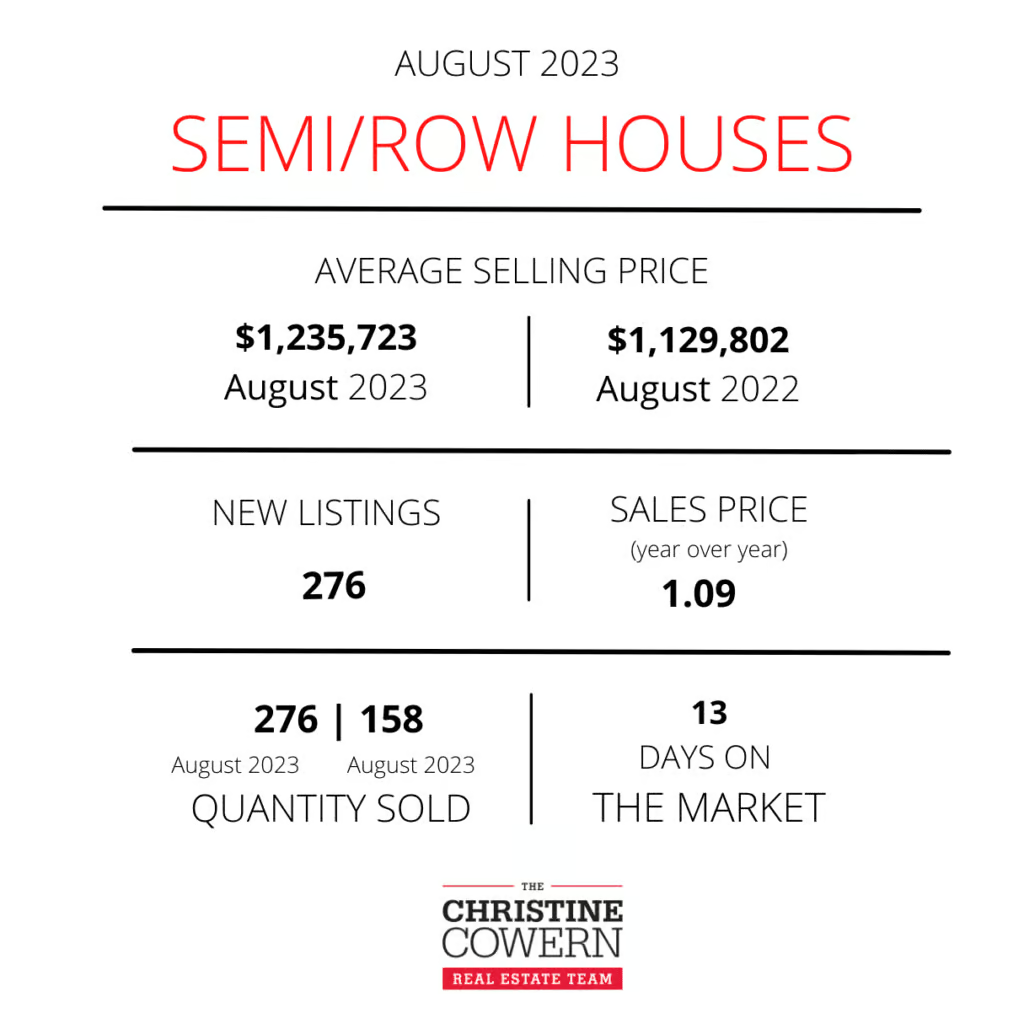

Greater Toronto Area REALTORS® reported 5,294 sales in August 2023 – down by 5.2 percent compared to August 2022. New listings were up by 16.2 percent year-over-over, providing some relief on the supply front, but year-to-date listings are still down substantially compared to the same period last year. Seasonally adjusted sales were down slightly by one percent month-over-month compared to July 2023, while new listings were up slightly by 1.3 percent compared to July.

“More balanced market conditions this summer compared to the tighter spring market resulted in selling prices hovering at last year’s levels and dipping slightly compared to July. As interest rates continued to increase in May, after a pause in the winter and early spring, many buyers have had to adjust their offers in order to qualify for higher monthly payments. Not all sellers have chosen to take lower than expected selling prices, resulting in fewer sales,” said TRREB Chief Market Analyst Jason Mercer.

The MLS® Home Price Index Composite benchmark for August 2023 was up by 2.5 percent year-over-year. The average selling price was also up, but by less than one percent to $1,082,496 over the same timeframe. On a month-over-month seasonally adjusted basis, the MLS® HPI Composite benchmark was virtually unchanged, and the average price edged lower by 1.6 percent.

“While higher interest rates have certainly impacted affordability, the prospect of higher taxes will also hit households’ balance sheets, especially younger buyers with limited savings. With the City of Toronto moving to raise the municipal land transfer tax (MLTT) rate on properties over $3 million as a revenue tool, it must also consider helping first-time home buyers struggling to enter the market by adjusting their tax rebate threshold to reflect today’s higher home prices,” said TRREB CEO John DiMichele.

Condo Market Update

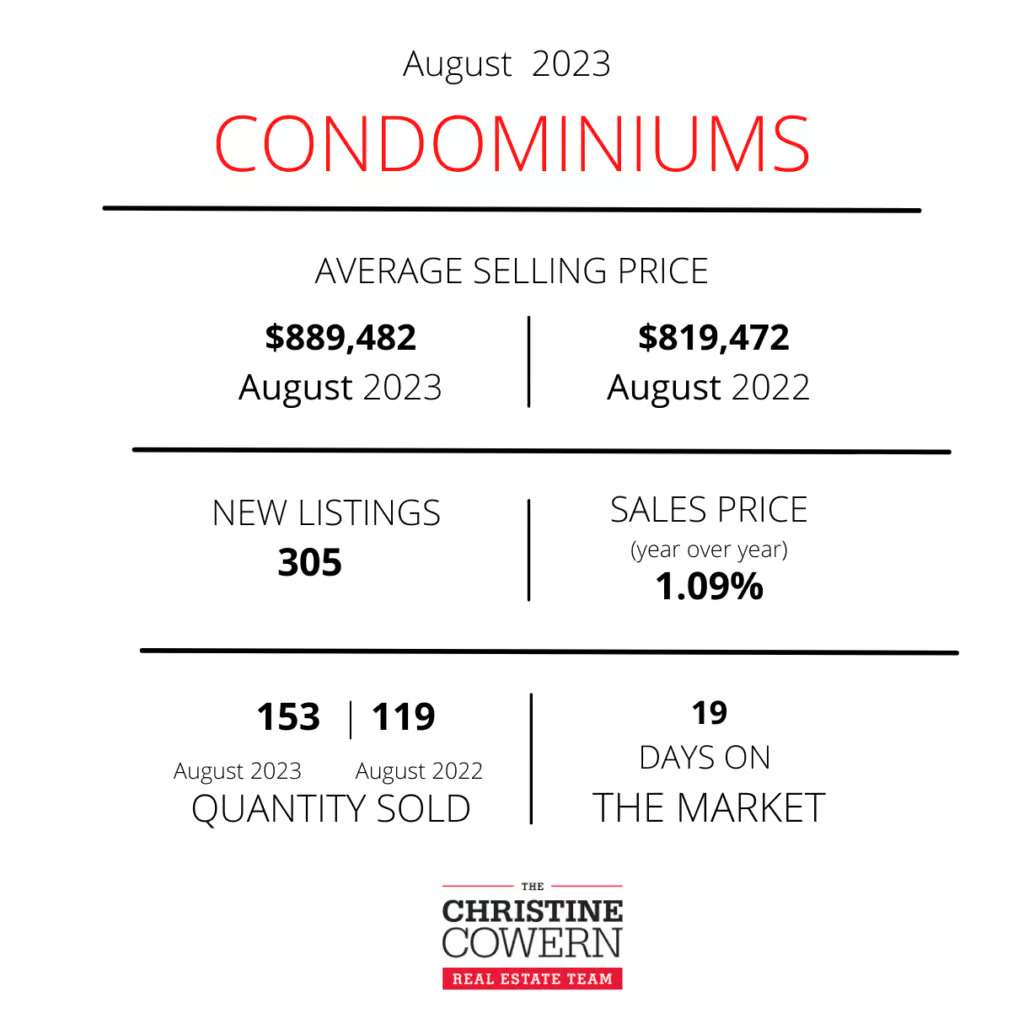

TORONTO, ONTARIO, July 13, 2023 3 Market conditions in the condominium apartment segment tightened markedly in the second quarter of 2023. Sales were up strongly on a year-over-year basis, whereas the number of new listings was down sharply. With more competition between buyers, average condominium apartment selling prices should climb above last year’s levels in the second half of this year.

“Strong population growth and an extremely competitive rental market have resulted in an increase in condominium apartment sales over the past year. Average condo selling prices remain below last year’s levels, which has helped from an affordability perspective.

However, as sales increase relative to the number of listings available, expect condo prices to trend upward in the months ahead,” said Toronto Regional Real Estate Board (TRREB) President Paul Baron.

Total condominium apartment sales amounted to 6,844 in Q2 2023 3 up by more than 20 percent on a year-over-year basis. New condo listings were down by more than 13 percent over the same period. This divergence between condo sales and listings also meant that active listings at the end of Q2 2023 were down by eight percent compared to the end of Q2 2022.

The average selling price for a condominium apartment GTA-wide was $737,868 in Q2 2023 3 down by 4.2 percent compared to $770,539 in Q2 2022. In the City of Toronto, which accounted for two-thirds of total condo sales, the average selling price was $769,616. This result was down by 3.3 percent compared to Q2 2022.

“Average rents have increased well-above the rate of inflation over the past two years 3 often by double-digit annual rates. Consumer polling conducted for TRREB by Ipsos has shown that these recent increases are pushing households back into the ownership market despite higher borrowing costs. This goes a long way to explaining why condo sales have increased over the past year,” said TRREB Chief Market Analyst Jason Mercer.

If you’re thinking of selling or buying a property or just want to pick our brains, we’re here to help! Just email us at hello@christinecowern.com or call us at 416-291-7372. We’d love to connect!