Ownership housing affordability continued to improve in June 2025. Average selling prices and borrowing costs remained lower than last year’s levels. However, despite some month-over-month momentum, many would-be homebuyers remained on the sidelines due to economic uncertainty.

“The GTA housing market continued to show signs of recovery in June. With more listings available, buyers are taking advantage of increased choice and negotiating discounts off asking prices. Combined with lower borrowing costs compared to a year ago, homeownership is becoming a more attainable goal for many households in 2025,” said Toronto Regional Real Estate (TRREB) President Elechia Barry-Sproule.

Greater Toronto Area (GTA) REALTORS® reported 6,243 home sales through TRREB’s MLS® System in June 2025 – down by 2.4 per cent compared to June 2024. New listings entered into the MLS® System amounted to 19,839 – up by 7.7 per cent year-over-year.

On a seasonally adjusted basis, June home sales increased month-over-month compared to May 2025. New listings declined compared to May. The monthly increase in sales coupled with the monthly decline in new listings continued the tightening trend experienced during the spring.

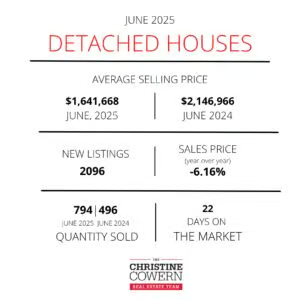

The MLS® Home Price Index Composite benchmark was down by 5.5 per cent year-over-year in June 2025. The average selling price, at $1,101,691 was down by 5.4 per cent compared to June 2024. On a month-over-month seasonally adjusted basis, the MLS® HPI Composite and average selling price both edged lower compared to May 2025.

“A firm trade deal with the United States accompanied by an end to cross-border sabre rattling would go a long way to alleviating a weakened economy and improving consumer confidence. On top of this, two additional interest rate cuts would make monthly mortgage payments more comfortable for average GTA households. This could strengthen the momentum experienced over the last few months and provide some support for selling prices,” said TRREB Chief Information Officer Jason Mercer.

“It is important to highlight that housing is not just impacted by economic and financial issues. Canadian residents, both homeowners and renters alike, are increasingly having to deal with the nightmare of violent home invasions and carjackings,” said TRREB CEO John DiMichele.

“TRREB is encouraged by the recent federal announcement to table a crime bill this Fall introducing stricter bail conditions and sentencing for these disturbing crimes. While this is a good first step by the federal government to strengthen public safety, more is needed, such as working with provinces to increase law enforcement funding and improve capacity and efficiency in the court system,” continued DiMichele.

.

Condo Market Update

Condominium apartment buyers benefitted from more choice in the Greater Toronto Area (GTA) marketplace in Q1 2025 compared to the same period last year. The number of transactions was lower, whereas the number of listings was up. Increased choice provided buyers with more negotiating power on price.

Q1 2025 condominium apartment sales amounted to 3,794 in the GTA – down 21.7 per cent compared to 4,843 sales in Q1 2024. There were 14,544 new listings in Q1 2025 – up by 25.2 per cent year-over-year to 11,614. The Q1 2025 average selling price was $680,146. This result represented a 2.2 per cent decrease compared to the average of $695,555 in Q1 2024.

Consumer polling undertaken by Ipsos for TRREB suggests that would-be homebuyers still require some relief on the borrowing cost front. In addition, confidence in the economy has temporarily waned due to uncertainty surrounding Canada’s trade relationship with the United States. Because the condominium rental market has also been well-supplied over the

past year, fewer renters have entertained the move to home ownership. Instead, renters have taken advantage of increased inventory to negotiate more competitive monthly rents.

The expectation is that we will see further rate cuts in 2025. Once economic confidence improves in the months ahead, the demand for condominium apartments should increase as well.

If you’re thinking of selling or buying a property or just want to pick our brains, we’re here to help! Just email us at hello@christinecowern.com or call us at 416-291-7372. We’d love to connect!