March 2024 home sales reported through TRREB’s MLS® System were lower than the March 2023 result, due in part to the statutory holiday Good Friday falling in March this year versus April last year. Despite a better-supplied market compared to last year, there was enough competition between buyers to see a moderate increase in the average March home price compared to last year’s level.

Greater Toronto Area (GTA) REALTORS® reported 6,560 sales through TRREB’s MLS® System in March 2024 – down by 4.5 per cent compared to March 2023. New listings were up by 15 per cent over the same period. On a seasonally adjusted monthly basis, sales were down by 1.1 per cent. New listings were down by three per cent compared to February.

The first quarter ended with sales up by 11.2 per cent year-over-year. New listings were up by a greater annual rate of 18.3 per cent.

“We have seen a gradual improvement in market conditions over the past quarter. More buyers have adjusted to the higher interest rate environment. At the same time, homeowners may be anticipating an improvement in market conditions in the spring, which helps explain the marked increase in new listings so far this year. Assuming we benefit from lower borrowing costs in the near future, sales will increase further, new listings will be absorbed, and tighter market conditions will push selling prices higher,” said TRREB President Jennifer Pearce.

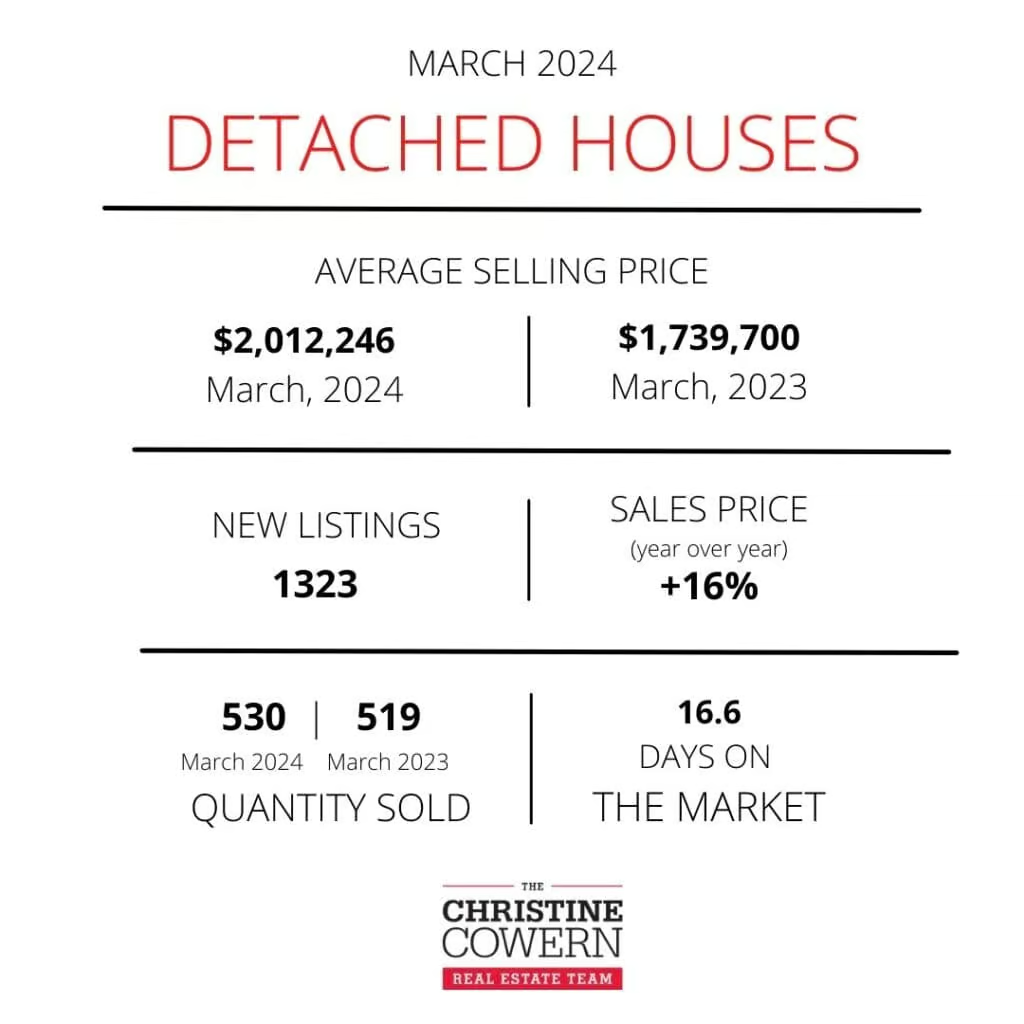

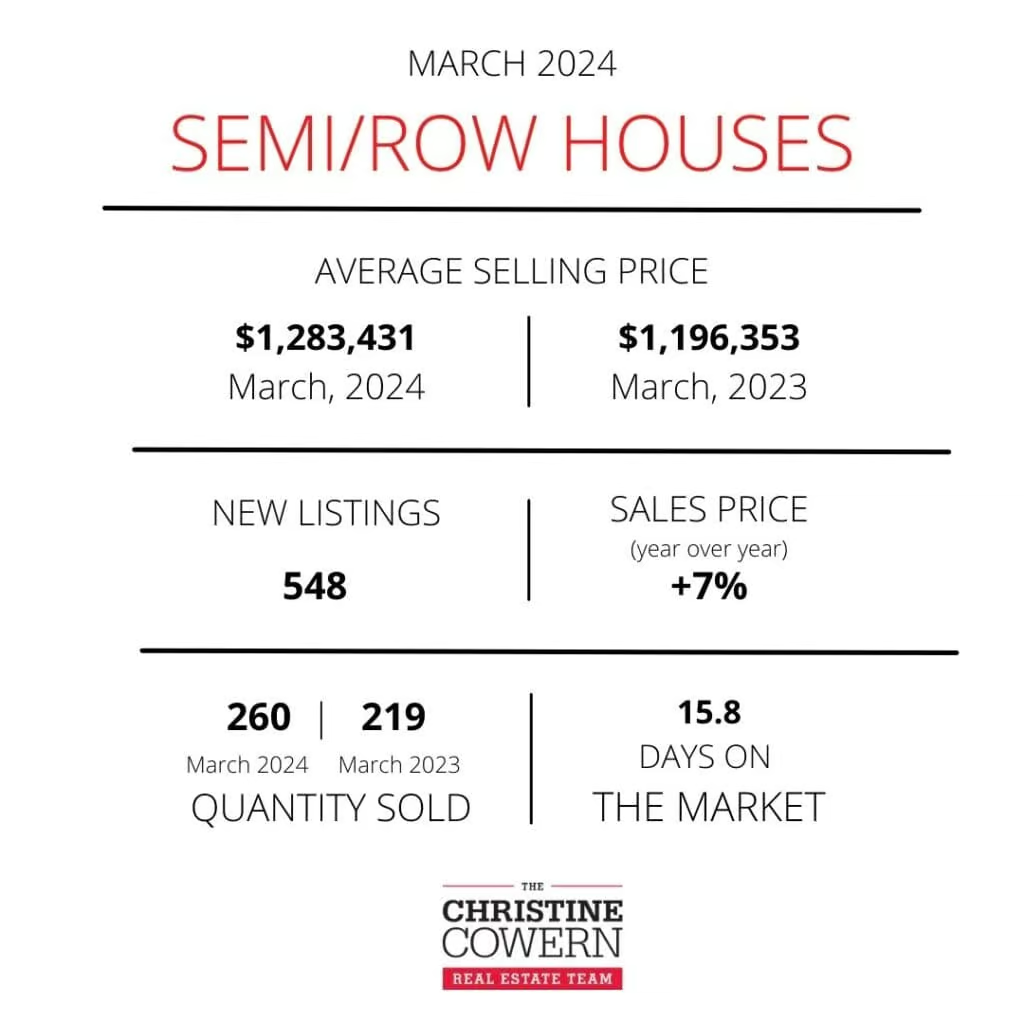

The MLS® Home Price Index (HPI) Composite benchmark was up by 0.3 per cent year-over-year. The average selling price was up by 1.3 per cent to $1,121,615. On a seasonally-adjusted month-over-month basis, the MLS® HPI Composite was up by 0.2 per cent and the average selling price was up by 0.7 per cent compared to February. “The average selling price edged up in comparison to last year as we moved through the first quarter of 2024. Price growth is expected to accelerate during the spring and even more so in the second half of the year, as sales growth catches up with listings growth and sellers’ market conditions start to emerge in many neighbourhoods. Lower borrowing costs in the months ahead will help fuel increased demand for ownership housing,” said TRREB Chief Market Analyst Jason Mercer.

“As demand for ownership and rental housing increases, supply will continue to be top of mind. Governments at all levels must maintain their focus on pursuing innovative solutions to increase the amount and mix of housing supply to improve affordability. This includes removing roadblocks to non-traditional arrangements, such as co-ownership models to benefit home buyers, including first-time buyers and seniors. Encouraging gentle density, including multiplexes, is critical to helping high demand areas such as the Greater Golden Horseshoe to meet housing supply targets,” said TRREB CEO John DiMichele.

Condo Market Update

Fourth quarter 2023 condominium apartment sales in the Greater Toronto Area (GTA) remained low historically, as the demand for ownership

housing continued to be hampered by affordability concerns brought about by high borrowing costs. Buyers who were active in the market benefitted from a substantial amount of choice. This meant that average selling prices were slightly lower than the fourth quarter of 2022.

“The condominium apartment market, like other segments of the homeownership market, experienced a pull-back in activity since the Bank of Canada started hiking interest rates in early 2022. However, looking forward, borrowing costs are expected to trend lower this year and next. This will improve the affordability picture for many first-time buyers, so the condo market is poised for improvement in 2024,” said TRREB President Jennifer Pearce.

Total condominium apartment sales amounted to 3,446 in Q4 2023 – down by 3.4 percent on a year-over-year basis. New condominium apartment listings were up by more than 29 percent over the same period. This divergence between condominium apartment sales and listings also meant that market conditions became more balanced.

The average condominium apartment selling price in the GTA was $702,142 in Q4 2023 – down by 1.1 percent compared to $710,124 in Q4 2022. In the City of Toronto, which accounted for more than two-thirds of total condominium apartment sales, the average selling price was $720,456. This result was down by 2.4 percent compared to Q3 2022. “Condominium apartment prices remained relatively flat over the past year. Buyers had plenty of negotiating power given the level of supply in the marketplace. As we move through 2024, demand for condominium apartments should pick up. Expected decreases in borrowing costs coupled with high average rents could prompt more households to purchase a home over the next year. Condominium apartments are a key entry point into the ownership market,” said TRREB Chief Market Analyst Jason Mercer.

If you’re thinking of selling or buying a property or just want to pick our brains, we’re here to help! Just email us at hello@christinecowern.com or call us at 416-291-7372. We’d love to connect!