GTA REALTORS®RELEASE APRIL STATS

The Greater Toronto Area (GTA) housing market continued its adjustment to higher borrowing costs, with the number of transactions down on a monthly and annual basis. As has been the case with previous rate tightening cycles, some home buyers have moved to the sidelines to determine how they will reposition themselves in the marketplace given the higher rate environment and related impact on affordability.

“Based on the trends observed in the April housing market, it certainly appears that the Bank of Canada is achieving its goal of slowing consumer spending as it fights high inflation. Negotiated mortgage rates rose sharply over the past four weeks, prompting some buyers to delay their purchase. Moving forward, it will be interesting to see the balance the Bank of Canada strikes between combatting inflation versus stunting economic growth and related government revenues as we continue to recover from and pay for pandemic-related programs,” said TRREB President Kevin Crigger.

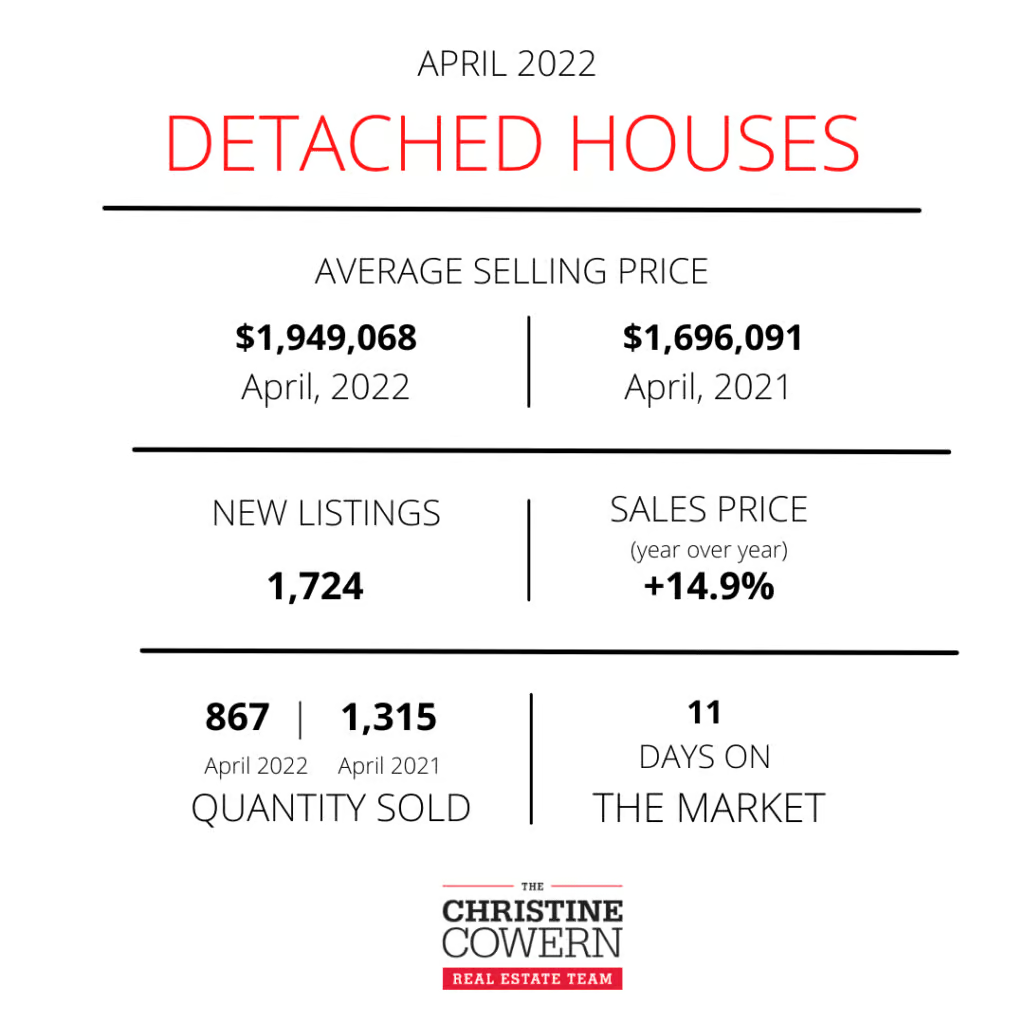

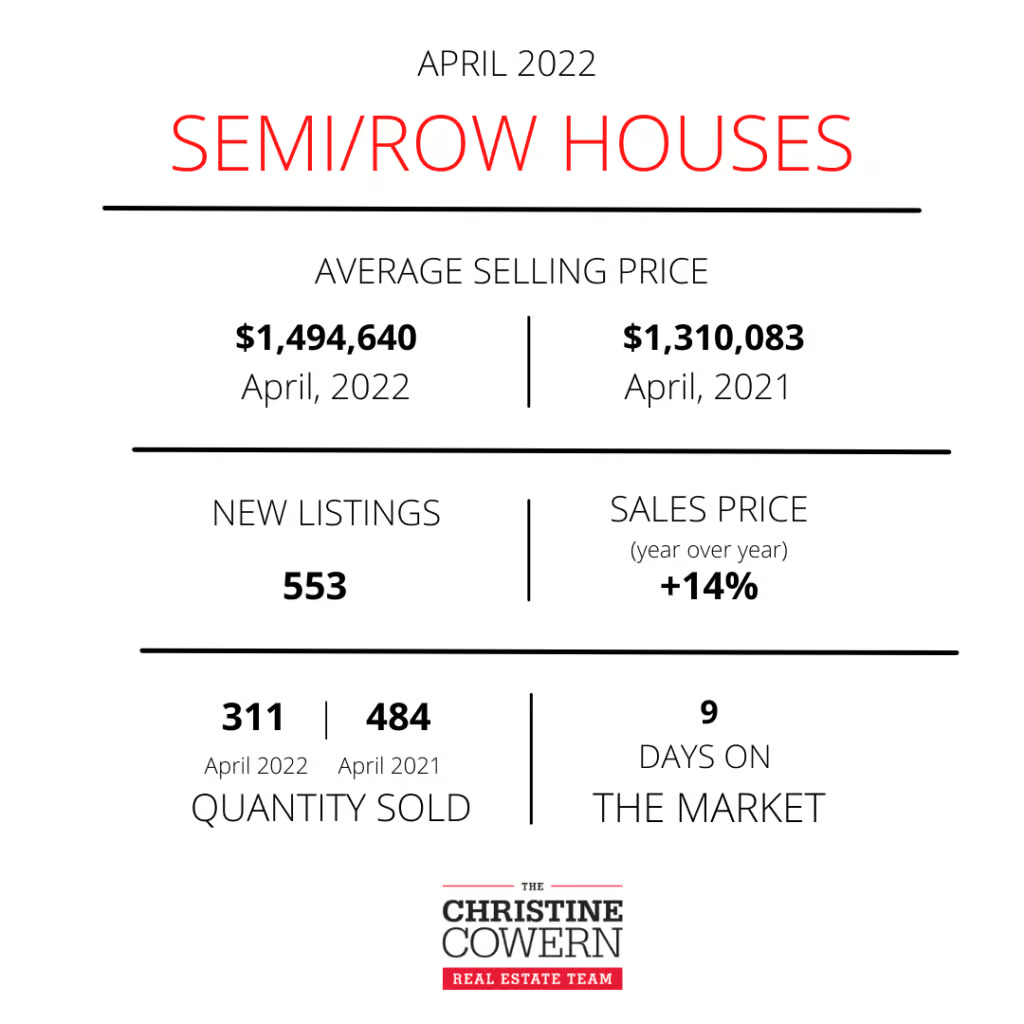

GTA REALTORS® reported 8,008 homes sold through TRREB’s MLS® System in April 2022 – a 41.2 percent decrease compared to April 2021 and a 27 percent decrease compared to March 2022. On a year-over-year basis, the decline in sales was greater in the ‘905’ area code regions surrounding Toronto, particularly for detached houses.

The MLS® Home Price Index Composite Benchmark was up by 30.6 percent year-over-year in April 2022. The benchmark level in April was down in comparison to the March level. The average selling price, at $1,254,436, was up by 15 percent compared to April 2021, but down compared to the average selling price of $1,300,082 in March 2022.

“Despite slower sales, market conditions remained tight enough to support higher selling prices compared to last year. However, in line with TRREB’s forecast, there is evidence of buyers responding to increased choice in the marketplace, with the average and benchmark prices dipping month-over-month. It is anticipated that there will be enough competition between buyers to support continued price growth relative to 2021, but the annual pace of growth will moderate in the coming months,” said TRREB Chief Market Analyst Jason Mercer.

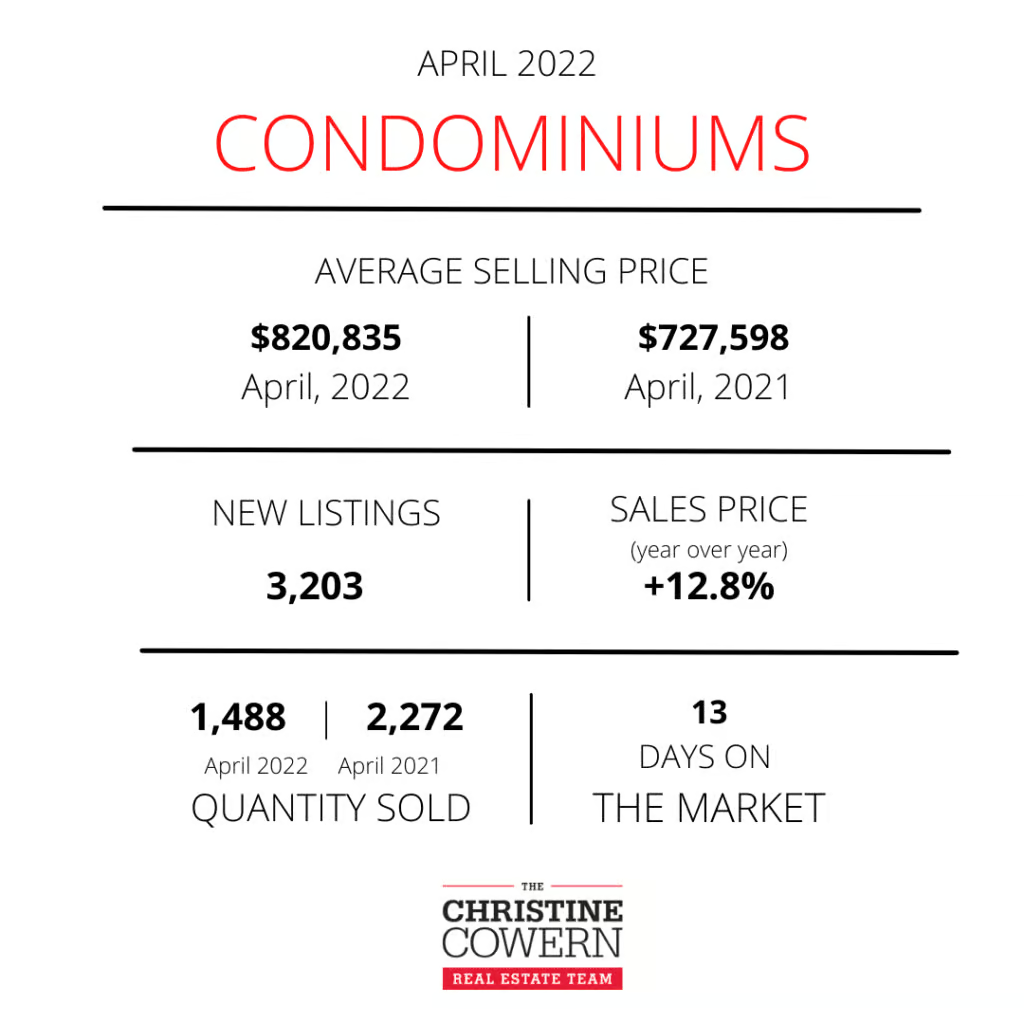

Q1 2022 CONDO MARKET REPORT

Condominium apartment sales remained strong historically in Q1 2022. Seller’s market conditions remained in place with the average selling price increasing by more than 20 percent year-over-year.

Greater Toronto Area (GTA) REALTORS® reported 7,932 sales through TRREB’s MLS® System in Q1 2022 – a decrease of 15.6 percent compared to the record Q1 2021 result of 9,399 sales.“

“Condominium apartments represent a key market segment in the GTA, providing housing for an array of households. Many first-time buyers see condos as an affordable entry point into homeownership. At the other end of the spectrum, condos provide a luxury alternative for many households. It is also important to note that investor-owned condominium apartments have been an important source of rental supply over the past decade,” said TRREB President Kevin Crigger.

While first-quarter sales were down year-over-year, new listings of condominium apartments were basically flat, meaning condo buyers had some relief in terms of market conditions. However, market conditions remained tight enough to support double-digit annual average price gains, with the average condominium apartment selling price increasing by 22.5 percent to $790,398.

“The GTA population will grow at or near record levels over the next few years, supported by a strong regional economy. The condominium apartment segment will be an important source of housing, both for people looking to purchase a home and also those looking to rent. This will continue to support price growth, but the pace of price appreciation may moderate as the market becomes more balanced over the next year,” said TRREB Chief Market Analyst Jason Mercer.