Homeownership market activity in November continued to be influenced by the impact of higher borrowing costs on affordability. Sales were down markedly compared to the same period last year, following the trend that unfolded since the commencement of interest rate hikes in the spring. New listings were also down substantially from last year, and at a very low level historically. The fact that the supply of homes for sale has remained low, has supported average selling prices at the $1.08 to $1.09 million mark since August.

Greater Toronto Area (GTA) REALTORS® reported 4,544 sales through TRREB’s MLS® System in November 2022 – down 49 per cent compared to November 2021, but remaining at a similar level to October especially after considering the recurring seasonal downward trend in the fall. New listings, at 8,880, were down on both a year-over-year basis and month-over-month basis.

“Increased borrowing costs represent a short-term shock to the housing market. Over the medium- to long-term, the demand for ownership housing will pick up strongly. This is because a huge share of record immigration will be pointed at the GTA and the Greater Golden Horseshoe (GGH) in the coming years, and all of these people will require a place to live, with the majority looking to buy. The long-term problem for policymakers will not be inflation and borrowing costs, but rather ensuring we have enough housing to accommodate population growth,” said TRREB President Kevin Crigger.

“We have seen a lot of progress this year on the housing supply and related governance files such as the More Homes Built Faster Act. This is obviously good news. However, we need these new policies to turn into results over the next year. Otherwise, the current market lull will soon be behind us, population growth will be accelerating, and we will have done nothing to account for our growing housing need. The result would be enhanced unaffordability and reduced economic competitiveness,” said TRREB CEO John DiMichele.

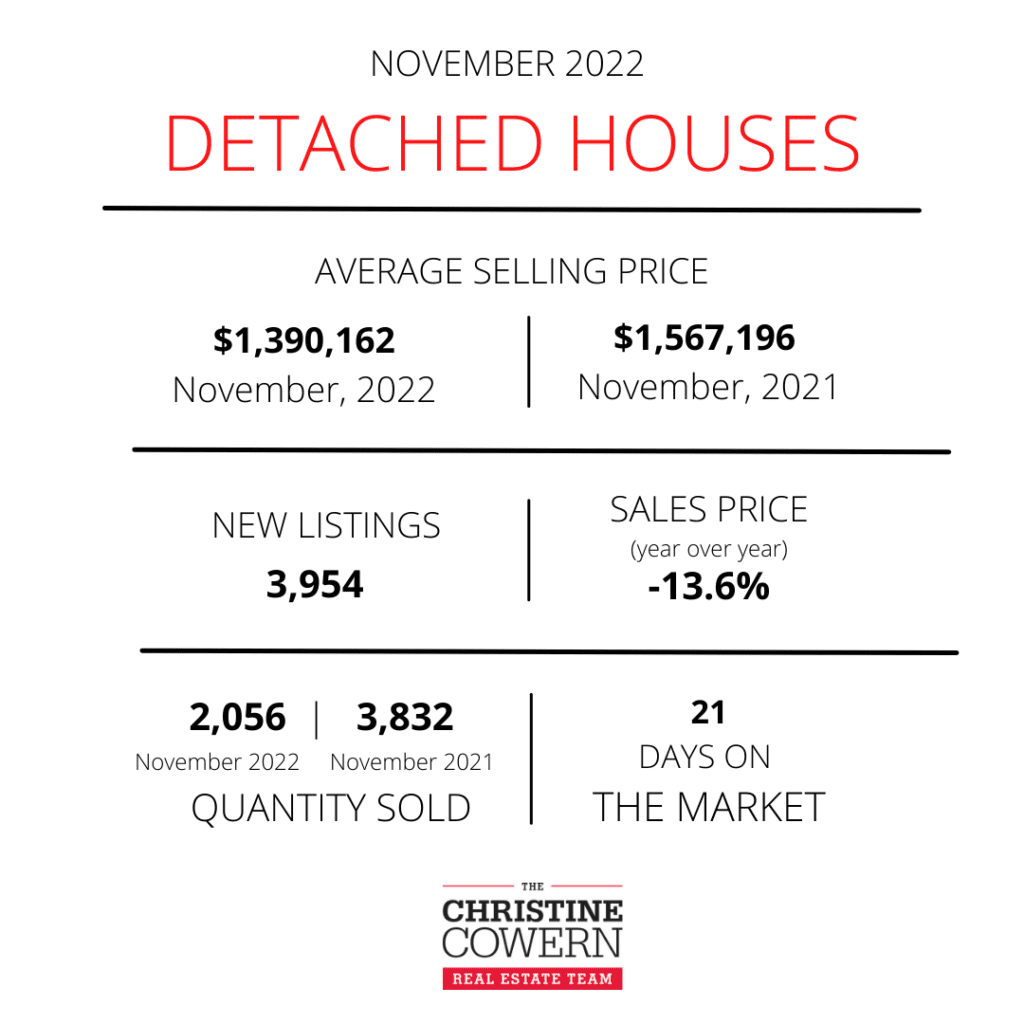

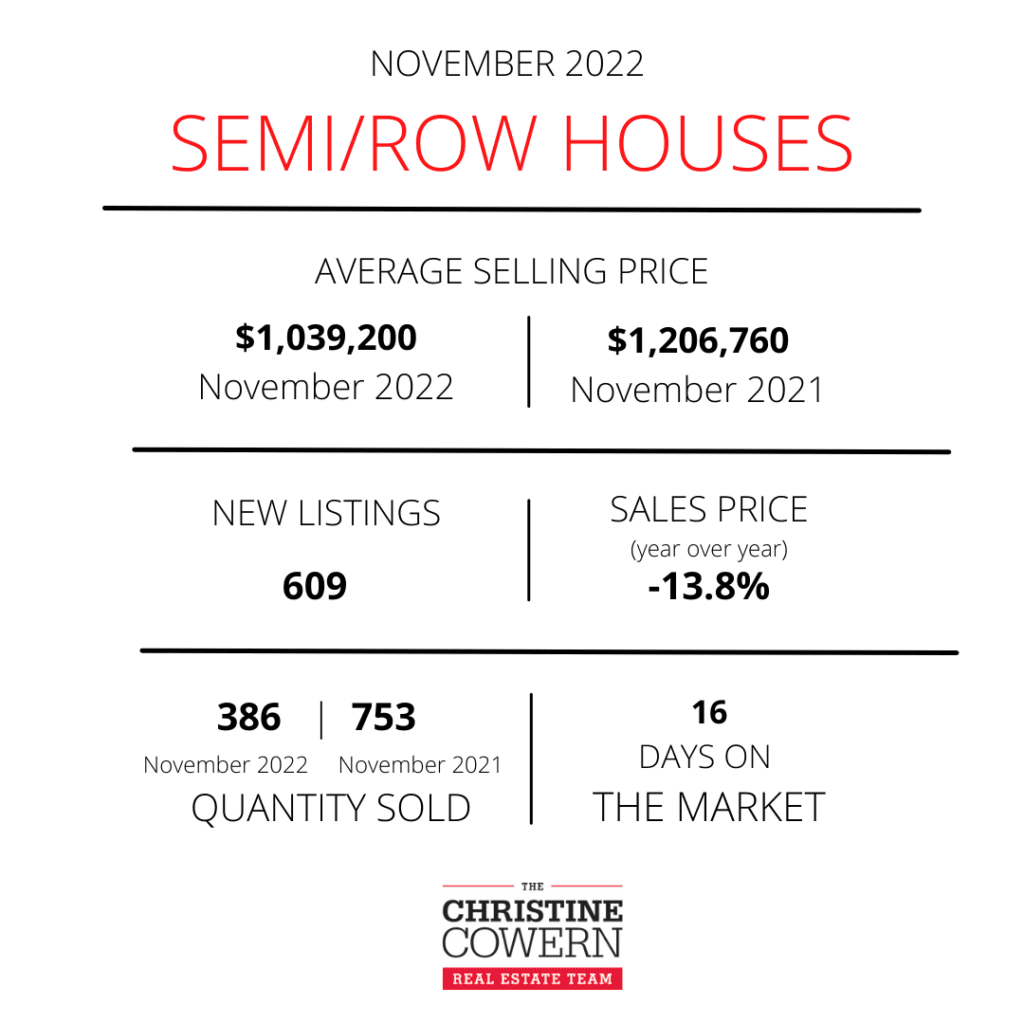

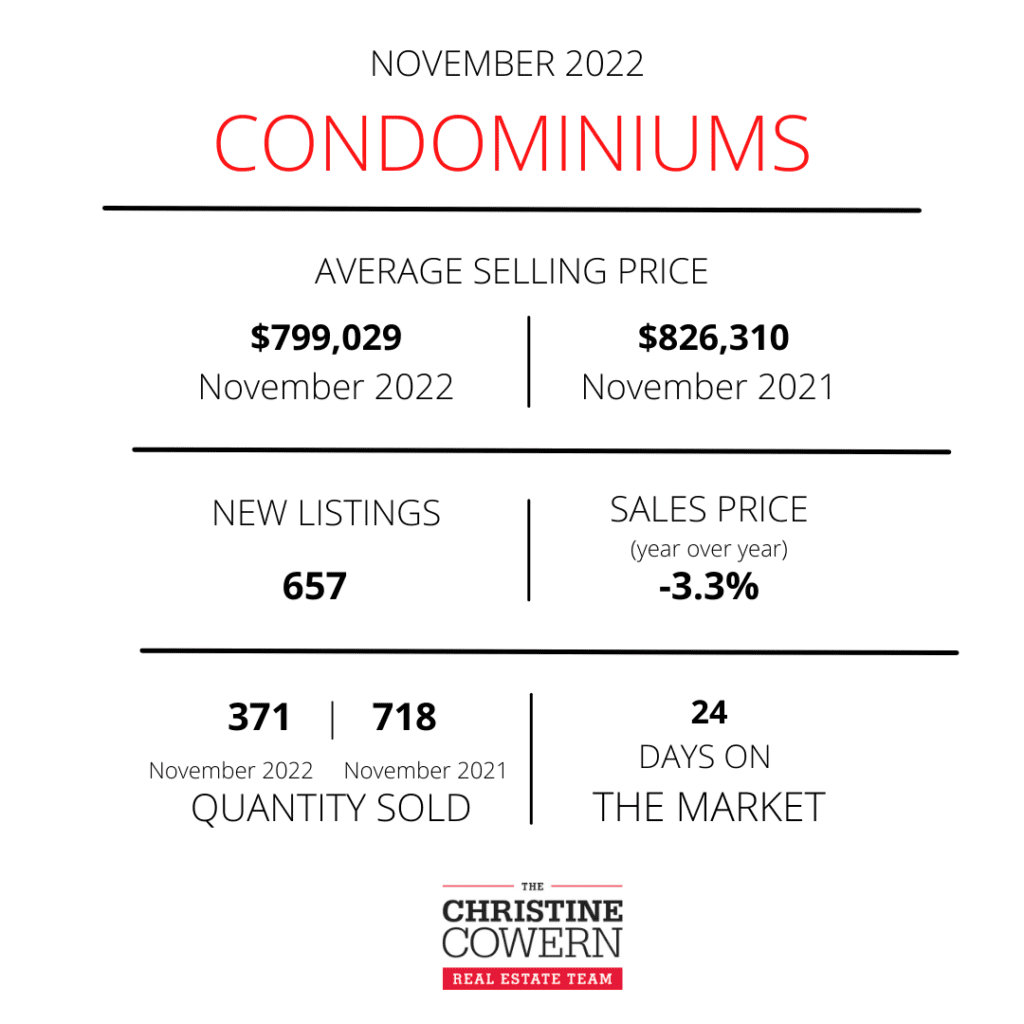

The MLS® Home Price Index Composite Benchmark was down by 5.5 per cent year-over-year in November 2022. The average selling price for all home types combined was down by 7.2 per cent year-over-year. Annual price declines continued to be greater for more expensive market segments, including detached and semi-detached houses.

“Selling prices declined from the early year peak as market conditions became more balanced and homebuyers have sought to mitigate the impact of higher borrowing costs. With that being said, the marked downward price trend experienced in the spring has come to an end. Selling prices have flatlined alongside average monthly mortgage payments since the summer,” said TRREB Chief Market Analyst Jason Mercer.

CONDO MARKET REPORT

Following the ownership market as a whole, Q3 2022 condominium apartment sales were off by approximately 46 percent compared to Q3 2021. Despite there being substantially more balance in the market in the third quarter relative to a year earlier, the average selling price was up year-over-year, albeit by less than the current pace of inflation.

There were 4,177 condo apartment sales reported through TRREB’s MLS® System in Q3 2022 compared to 7,795 in Q3 2021. The number of new listings was also down over the same period by 16 per cent to 10,258.

“The condo market remains a very important segment in the GTA housing market, both in terms of ownership and rental. The ownership side of the market has been slower, as some first-time buyers have been sidelined by higher borrowing costs and the hit on affordability. Many of these would-be buyers have shifted to the condo rental market in the short-to-medium term to meet their housing needs,” said TRREB President Kevin Crigger.

The average selling price for condominium apartments in Q3 2022 was $720,132 – up 4.5 percent compared to $689,230 reported for Q3 2021. In the City of Toronto, the average selling price was $749,375 – up 3.3 percent.

“The pace of condo price growth has moderated as higher borrowing costs have hampered affordability since the spring. However, the impact has been mitigated to a certain degree by a dip in listings over the same period. A shorter supply of condos will likely provide some support for prices in the months ahead,” said TRREB Chief Market Analyst Jason Mercer.

If you’re thinking of selling or buying a property or just want to pick our brains, we’re here to help! Just email us at hello@christinecowern.com or call us at 416-291-7372. We’d love to connect!