Annual Greater Toronto Area (GTA) home sales declined in 2025 compared to 2024, as economic uncertainty weighed on consumer confidence. Over the same period, listing inventory remained elevated, allowing for selling prices to be negotiated downward, helping improve affordability.

“The GTA housing market became more affordable in 2025 as selling prices and mortgage rates trended lower. Improved affordability has set the market up for recovery. Once households are convinced that the economy and labour market are on a solid footing, sales will increase as pent-up demand is satisfied,” said Toronto Regional Real Estate Board (TRREB) President Daniel Steinfeld.

For calendar year 2025, GTA REALTORS® reported 62,433 home sales through TRREB’s MLS® System – down by 11.2 per cent compared to 2024. New listings amounted to 186,753 – up by 10.1 percent year-over-year. The annual average selling price in 2025 was $1,067,968 – down by 4.7 per cent compared to $1,120,241 in 2024.

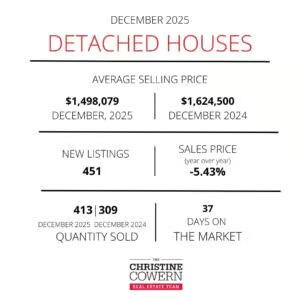

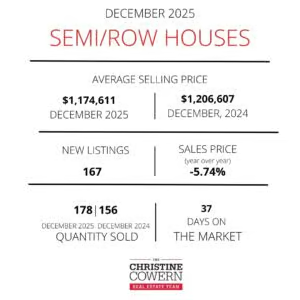

There were 3,697 home sales reported in December 2025 – down by 8.9 percent compared to December 2024. New listings entered into the MLS® System amounted to 5,299 – up by 1.8 percent year-over-year.

The MLS® Home Price Index (MLS® HPI) Composite benchmark was down by 6.3 percent year-over-year in December 2025. The average selling price, at $1,006,735, was down by 5.1 percent compared to December 2024. On a seasonally adjusted basis, December home sales were down slightly month-over-month compared to November 2025, while new listings were up. The MLS® HPI composite trended slightly lower compared to November while the average selling price edged higher.

“Reaffirmed trade relationships and large-scale domestic economic development projects will be key for improved home sales moving forward. GTA households must be confident in their employment situation before committing to long-term monthly mortgage payments, even in this more affordable market,” said TRREB Chief Information Officer Jason Mercer.

“We urge governments at all levels to take action now to provide tax relief for consumers and help ease the rising cost of living. Families and individuals need financial breathing room so they can afford a home or apartment and meet their basic needs. Fair and responsible tax policies can put more money back into people’s pockets, restore consumer confidence, and rebuild trust in the economy. These actions are essential to support stable households and create an economy that works for everyone,” said TRREB CEO John DiMichele.

CONDO MARKET STATS

Greater Toronto Area (GTA) condominium apartment sales edged up in the third quarter of 2025 compared to Q3 2024. Active condo listings at the end of the third quarter were up by a greater annual rate than sales, keeping the market well-supplied. With listing inventory high historically, buyers continued to benefit from substantial choice and negotiating power on price.

There were 4,375 condominium apartment sales reported through the TRREB MLS® System in Q3 2025 – up by 2.5 percent compared to 4,269 sales in Q3 2024. The number of new listings entered into the System was down year-over-year by 2.7 percent. Despite Q3 new listings trending lower annually, active listings at the end of the period were up, reflecting the high level of standing inventory.

The negotiating power afforded to buyers by high inventory levels saw the average condo apartment selling price drop by 6.4 percent year-over-year in Q3 2025 to $649,168 compared to the average of $693,452 reported a year earlier. The average price in the City of Toronto, at $677,095, was higher than the GTA average, but still down from the Toronto average of $713,678 in Q3 2024.

Looking forward, the GTA condo market should continue to benefit from approved affordability. Lower average selling prices combined with lower mortgage rates will likely entice more first-time buyers off the sidelines. However, a potential drag on this movement into home ownership could be the fact that renters are currently benefitting from lower average rents. Therefore, renter households may have less of a financial impetus to move into home ownership.

If you’re thinking of selling or buying a property or just want to pick our brains, we’re here to help! Just email us at hello@christinecowern.com or call us at 416-291-7372. We’d love to connect